Market analysis with specific CENTURYTEX and HONASA stock review for short term trading recommendations. Here’s a summary of the key points:

Market Overview:

- Bullish Trend: The market is driven by volume, with small and mid-cap stocks being the major focus.

- Sector Focus: IT, Media, Realty, Private Banks, and Energy Infrastructure sectors are expected to be in focus in the coming weeks.

- Small and Mid-Caps: These stocks are underperforming compared to the index but are giving better results, leading to a record high in indices like Small Cap 50, Small Cap 100, and Small Cap 250.

- Middle East Tensions: Elevated tensions may disrupt supply chains, potentially leading to higher inflation, especially in crude oil and edible commodities.

- Precious Commodities: Gold and silver prices are expected to rise in the coming month.

Nifty Analysis:

- Current Status: Nifty closed above the 25,000 mark and formed a spinning top pattern within a 100-point range, close to its all-time high.

- Trading Strategy:

- Sell on Rise: If Nifty opens between 25,200 to 25,150, a sell on rise strategy is suggested.

- Buy on Dip: If there’s a gap-down opening between 24,850 to 24,900, consider buying on dips, especially during the morning trade session.

- Support Levels: 24,930 and 24,850.

- Resistance Levels: 25,120 and 25,200.

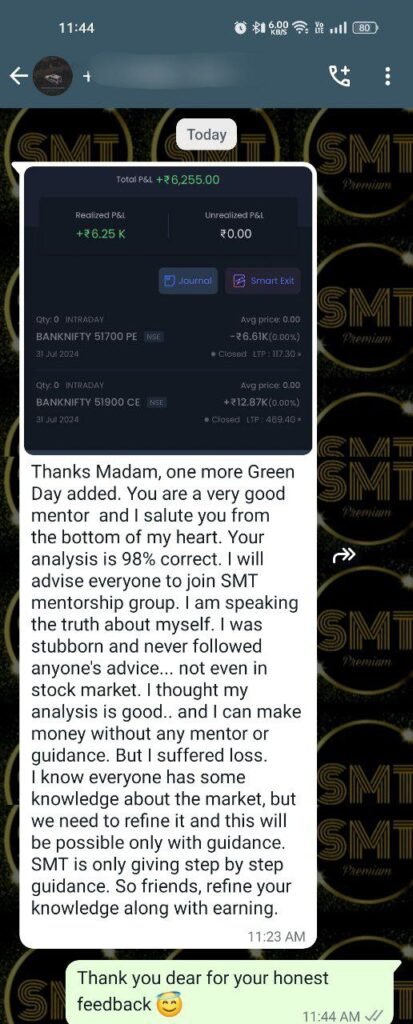

Bank Nifty Analysis:

- Support Levels: 50,950 and 50,820.

- Resistance Levels: 51,450 and 51,500.

Stock Recommendations:

- HONASA:

- Buy Range: 470 to 495.

- Targets: 525 / 540 / 565 / 580 / 610 / 640.

- Stop Loss: 430.

- Holding Period: 1 to 8 weeks.

- CENTURYTEX:

- Buy Range: 2340 to 2420.

- Targets: 2560 / 2600 / 2650 / 2700 / 2750 / 2800.

- Stop Loss: 2210.

- Holding Period: 1 to 25 days.

Would you like any additional analysis or clarification on specific points?

Join us here on telegram https://t.me/SMTStockMarketToday

Conclusion

In the current market environment, with changing dynamics and valuation concerns, it is essential for investors to be vigilant. While opportunities exist in specific stocks and sectors, the overall cautious sentiment suggests a need for careful stock selection and timely profit booking. As always, keeping an eye on technical levels and global cues will be critical in navigating the market in the coming weeks.

Disclaimer: V.L.A. Ambala emphasizes that these recommendations are based on price movement, past behavior, and technical analysis. Stay cautious and keep an eye on key levels and upcoming budget announcements to adjust your strategies accordingly.

Join SMT EQUITY Services here – https://cosmofeed.com/vig/64a2b98a2eaff10021550a62

Join SMT INDEX OPTION BUYING SERVICES here – https://cosmofeed.com/vig/6380ef829c9fa70036a1c6cd

More about the author: Vijay Laxmi, aka VLA Ambala, is a SEBI registered Research Analyst, and her research and views are published on various media platforms. Check here – https://smtstockmarkettoday.com/pr-and-media/

Follow VLA Ambala, SEBI RA, on Telegram here – https://t.me/SMTStockMarketToday

This analysis and recommendations are provided by SEBI registered research analyst VLA Ambala.

FOLLOW US ON TELEGRAM FOR MORE TRADES LINE THIS https://t.me/SMTStockMarketToday

Tags: banknifty tomorrowbansal ipoblogipo reviewlisting expacationmarket analysis for tomorrowmarket view

Tags: market analysis for tomorrow

Tags: banknifty tomorrowbansal ipoipo reviewmarket analysis for tomorrowstocks to eatch tomorrow