Market Update: Nifty 50 & Sector Highlights and key support and resistance for 8th August Thursday 2024

Nifty 50 Performance on 7 August 2024

- Gap-Up Opening: Nifty 50 opened with a gap up of over 1% and closed the day positively at 24,315, above the previous day’s close and the 50-day exponential moving average.

- Near-Term Outlook: It is likely to retest the 24,450 to 24,520 range within the next 3 days.

- India VIX: The volatility index has cooled off more than 20% over the past 2 days, with a 14% drop intraday.

Sector Performance:

- Leaders: Media and metals were the top performers of the day, though buying was observed across all sectors.

Technical Analysis:

- Moving Averages: The 20 and 50-day exponential moving averages are considered buying signals for mid to long-term investors, as previously discussed.

- Key Support Levels: Watch for support at 24,200 and 23,500, which are critical for maintaining the uptrend. The market remains overvalued on a monthly timeframe.

- Market Behavior: Historically, markets favor discounted prices, as evidenced by the IT sector receiving over ₹11,700 crore in FPI investments during the July series.

Investment Strategy:

- Short-Term: Volatility is expected to continue next week, so short-term investors should stay cautious.

- Long-Term: Long-term investors can consider starting partial investments, focusing on the key support ranges identified.

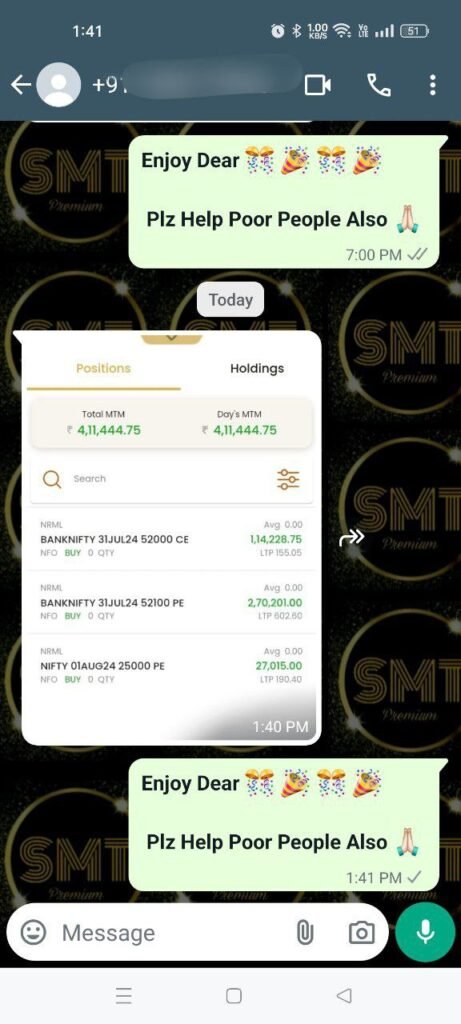

Nifty Bank:

- Support: 50,200 and 49,750

- Resistance: 50,650 and 51,000

Nifty:

- Support: 24,250 and 24,200

- Resistance: 24,470 and 24,565

Stock Watch:

- Tata Steel (TATASTEEL): Swing Trade Possible

- Buy: 152/154

- Target: 157/160/164/167/170/175/180

- Stop-Loss: 148

- Holding Period: 3 to 30 days

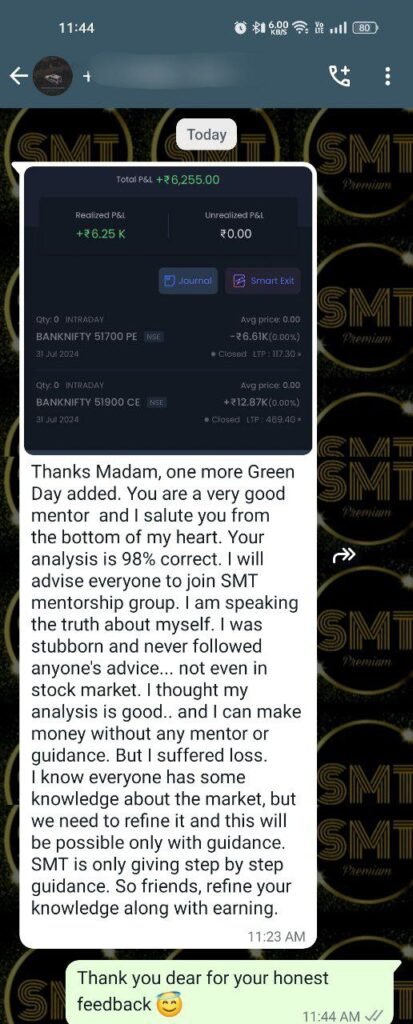

Credit: According to VLA Ambala, SEBI Registered Research Analyst and Founder of SMT Stock Market Today.

Given the current market conditions and the high valuation, it is advisable to adopt a cautious approach while investing. However, the identified sectors and stocks are trading at attractive prices and valuations, making them worth watching in the upcoming days.

For any updates or further recommendations, stay tuned and continue monitoring the market trends.

Disclaimer: V.L.A. Ambala emphasizes that these recommendations are based on price movement, past behavior, and technical analysis. Stay cautious and keep an eye on key levels and upcoming budget announcements to adjust your strategies accordingly.

Join SMT EQUITY Services here – https://cosmofeed.com/vig/64a2b98a2eaff10021550a62

Join SMT INDEX OPTION BUYING SERVICES here – https://cosmofeed.com/vig/6380ef829c9fa70036a1c6cd

More about the author: Vijay Laxmi, aka VLA Ambala, is a SEBI registered Research Analyst, and her research and views are published on various media platforms. Check here – https://smtstockmarkettoday.com/pr-and-media/

Follow VLA Ambala, SEBI RA, on Telegram here – https://t.me/SMTStockMarketToday

This analysis and recommendations are provided by SEBI registered research analyst VLA Ambala.

FOLLOW US ON TELEGRAM FOR MORE TRADES LINE THIS https://t.me/SMTStockMarketToday