Your analysis highlights key market indicators and potential strategies for Nifty and Bank Nifty, as well as a specific trading strategy for BSOFT. Here’s a summary of the current market scenario based on your insights:

Nifty50 Overview:

- Opening: Nifty50 opened with almost a 1% gap up but traded within a narrow range.

- Closing: It closed below its opening price, forming a small doji candlestick pattern on the daily timeframe.

- Current Position: Nifty50 is trading between the 20 and 50-day EMAs, about 3% below its all-time high.

- RSI: The RSI is cooling off on the daily timeframe but remains high on the weekly (68) and monthly (75) timeframes, suggesting a possible corrective move within the next 4 to 7 days.

- Candlestick Pattern: A “Hanging Man” pattern has formed on the weekly timeframe, which could indicate a potential reversal.

- Volatility: IndiaVIX declined by nearly 8% intraday, indicating reduced market volatility.

- Sector Performance: Media, IT, and PSU banks were the most active sectors today.

Key Levels for Nifty:

- Support: 24320, 24260

- Resistance: 24440, 24530

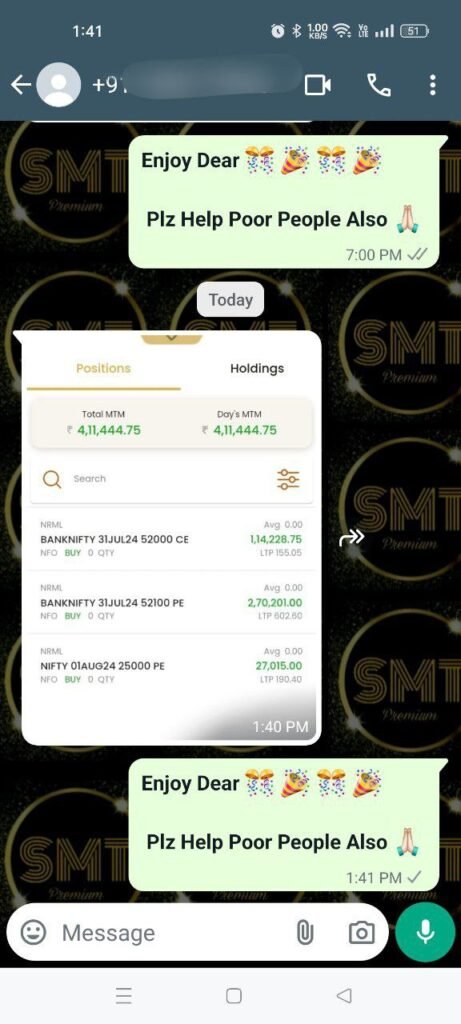

Key Levels for Bank Nifty:

- Support: 50250, 50010, 49850

- Resistance: 59850, 51200

Trading Strategy for BSOFT:

- Entry: ₹581

- Target: ₹595 to ₹645

- Stop Loss (SL): ₹550

- Holding Period: 2 to 10 days

This outlook indicates a cautious approach for Nifty and Bank Nifty with an eye on key support and resistance levels, while the BSOFT trade suggests potential short-term gains.

Disclaimer: V.L.A. Ambala emphasizes that these recommendations are based on price movement, past behavior, and technical analysis. Stay cautious and keep an eye on key levels and upcoming budget announcements to adjust your strategies accordingly.

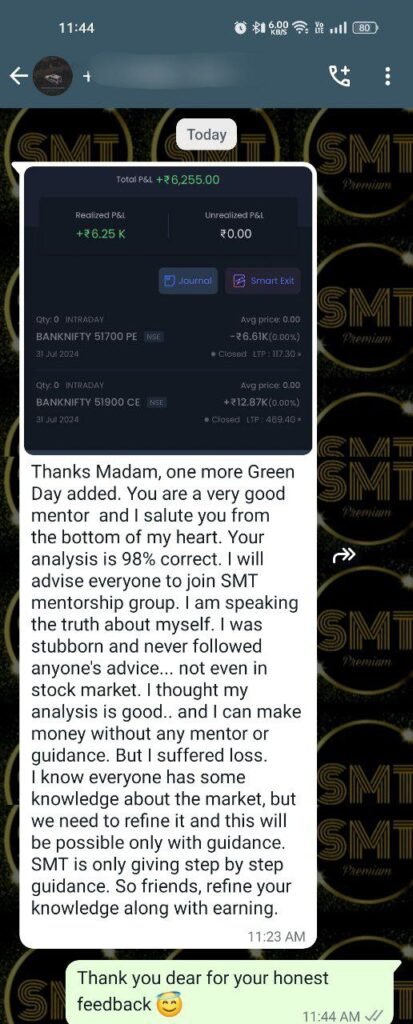

Join SMT EQUITY Services here – https://cosmofeed.com/vig/64a2b98a2eaff10021550a62

Join SMT INDEX OPTION BUYING SERVICES here – https://cosmofeed.com/vig/6380ef829c9fa70036a1c6cd

More about the author: Vijay Laxmi, aka VLA Ambala, is a SEBI registered Research Analyst, and her research and views are published on various media platforms. Check here – https://smtstockmarkettoday.com/pr-and-media/

Follow VLA Ambala, SEBI RA, on Telegram here – https://t.me/SMTStockMarketToday

This analysis and recommendations are provided by SEBI registered research analyst VLA Ambala.

FOLLOW US ON TELEGRAM FOR MORE TRADES LINE THIS https://t.me/SMTStockMarketToday

Tags: banknifty tomorrowbansal ipoblogipo reviewlisting expacationmarket analysis for tomorrowmarket view