“GSFC and Mangalam stock Financial Review: Navigating Volatility and Opportunities as of 26th August 2024″

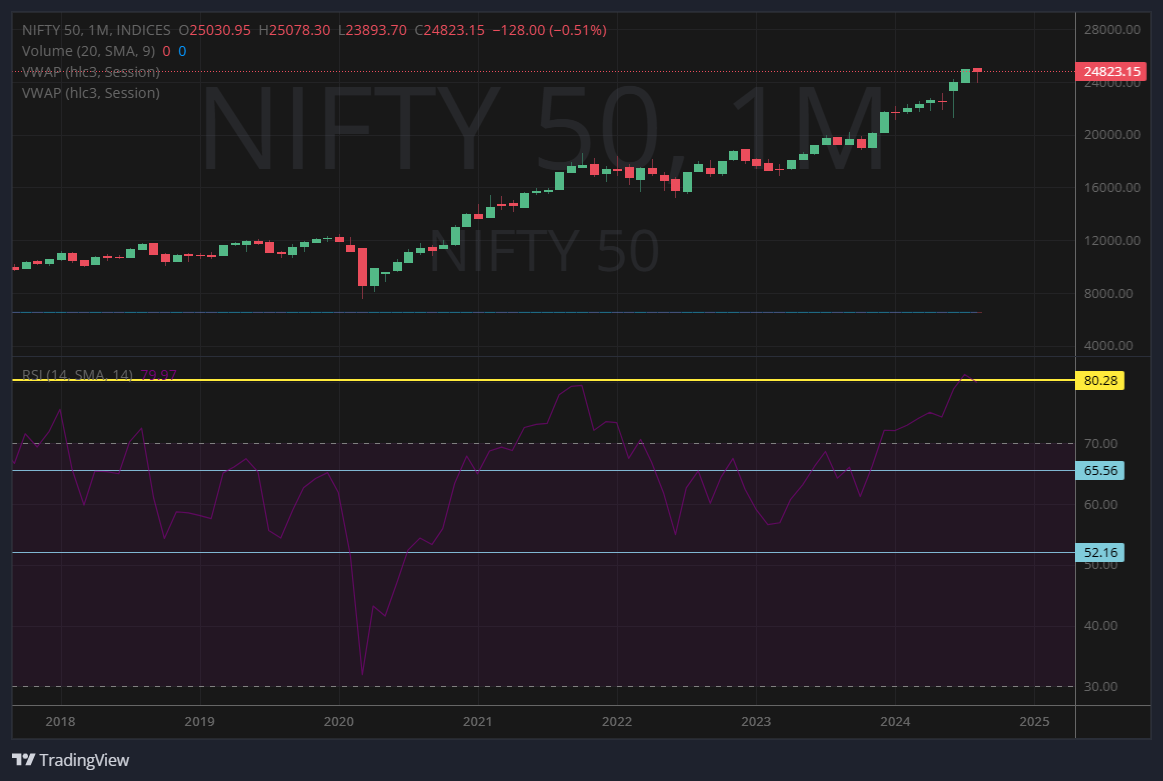

Market Overview: Nifty and Sectoral Outlook Amidst Global Dynamics

For the second consecutive day, Nifty closed with muted gains, forming a small Doji candlestick on the daily time frame. The index traded within a narrow 120-point range, ending the session with a marginal gain of 0.07% over the previous trading session. This pattern suggests indecision in the market, reflecting a cautious approach by traders and investors.

Valuation Concerns and Sectoral Risks

Valuation plays a critical role in investment decisions, and the current market scenario is heavily influenced by bullish sentiment. However, many sectors are currently overbought, raising concerns about potential corrections. Sectors such as Realty, Pharma, Consumption, and Metals are particularly vulnerable, with a likely decline of 3% to 5% expected in the August series. This calls for a more defensive approach, where investors should either avoid overbought stocks or book profits to safeguard their gains.

Nifty Smallcap Indices Reach New Highs

In contrast to the cautious sentiment in broader markets, Nifty Smallcap 50 and Nifty Smallcap 250 indices touched fresh all-time highs. This indicates strong momentum in smaller stocks, but it also warrants caution as these levels might attract profit-booking. In such a scenario, it becomes crucial for investors to avoid chasing overbought stocks and instead focus on disciplined profit-taking.

Market Dynamics and Global Focus on India

India, as the world’s largest consumer market, remains a focal point for the global economy. Despite challenges like high inflation and unemployment, India’s market sentiment is buoyed by this global attention. The resilience of the Indian market in the face of these headwinds highlights the importance of global players focusing on India to sustain their growth. This dynamic is a key factor supporting the current market despite underlying economic concerns.

Nifty Technical Levels

For the upcoming sessions, the key support levels for Nifty are 24760 and 24700, while resistance levels are pegged at 24890 and 24965. These levels will be crucial in determining the market’s short-term direction.

BANKNIFTY: Range-Bound Movement Expected

BANKNIFTY, too, has formed a high wave candlestick pattern for the second day in a row, closing above the 50933 mark. The price is likely to trade within a 600-point range over the next 1-2 days before any significant movement. Key support levels to watch are 50800 and 50500, with resistance at 51250 and 51450.

Stock Recommendations

Mangalam

Mangalam Drugs and Organics Limited: Financial Overview and Analysis

Company Overview:

Mangalam Drugs and Organics Limited, a micro-cap company with a market capitalization of ₹200 Crore, operates in the Pharmaceuticals sector. The company specializes in manufacturing a diverse range of chemicals, including active pharmaceutical ingredients (APIs), perfumery products, disperse dye intermediates, bulk drugs, and bulk drug intermediates.

- Stock Price: ₹132.83 (1-year gain of 22.4%)

- 52-Week Range: ₹90.80 – ₹132

- P/E Ratio: 62.43 (significantly higher than the sector P/E of 29.09)

- P/B Ratio: 1.46

- Dividend Yield: 0.84%

- ROE (Return on Equity): Not available

Financial Performance (₹ in Lakhs)

- Sales:

- The company has shown fluctuating sales over the last ten periods, with a notable increase in recent years. The latest recorded sales figure is ₹9,045 Lakhs.

- Operating Profit:

- Operating profit has also been variable, peaking at ₹1,617 Lakhs and then dropping to ₹461 Lakhs in the most recent period. The Operating Profit Margin (OPM) reflects this volatility, decreasing to 5.10% from a high of 16.59%.

- Other Income:

- Other income has been relatively steady, with a significant increase to ₹377 Lakhs in the latest period.

- Profit Before Tax (PBT):

- The PBT has similarly fluctuated, with a recent figure of ₹642 Lakhs, down from a peak of ₹1,568 Lakhs.

- Net Profit:

- Net profit saw a sharp rise to ₹1,293 Lakhs, followed by a drop to ₹511 Lakhs in the latest period, indicating some inconsistencies in profitability.

- Depreciation and Amortisation:

- These expenses have been steadily increasing, reaching ₹185 Lakhs in the most recent period.

- Interest Expenses:

- Interest expenses have decreased over time, showing better management of debt, with the latest figure being ₹11.04 Lakhs.

- Tax Expenses:

- Tax payments have been irregular, with a significant increase to ₹131 Lakhs in the most recent period.

Key Insights:

- Growth Prospects: Despite the high P/E ratio indicating a premium valuation, Mangalam Drugs has shown strong growth in the past, particularly in its net profit and sales figures. However, the recent decline in profitability and operating margins suggests potential challenges in sustaining this growth.

- Profitability Concerns: The decline in operating profit margin and net profit in the latest period could indicate underlying issues that need to be addressed, such as increasing operating expenses and inconsistent other income.

- Valuation and Investment Outlook: Given the current valuation, the stock appears expensive compared to its sector peers, with a P/E ratio more than double the sector average. The company’s ability to manage costs, particularly interest and operating expenses, will be crucial in maintaining profitability.

- Dividend Policy: The company’s dividend payout ratio has been decreasing, reflecting a cautious approach to returning profits to shareholders, possibly to reinvest in growth.

Conclusion:

Mangalam Drugs and Organics Limited presents a mixed investment case. While the company has shown strong historical growth, recent financials suggest some caution. Investors should carefully consider the high valuation and recent profitability trends before making any investment decisions. Holding the stock may be prudent, especially for those who have already seen gains, but new entrants should be mindful of potential risks.

Swing Possibilities –

- Buy Near: 128 to 131

- Targets: 140/145/152/160/165/180/200

- Stop Loss: 114

- Holding Period: 4 to 10 weeks

GSFC – Gujarat State Fertilizers & Chemicals Ltd. (GSFC): Financial Overview and Analysis

Company Overview:

Gujarat State Fertilizers & Chemicals Ltd. (GSFC) is a well-established player in the chemical and fertilizer sector with a market capitalization of ₹9,444 Crore. The company’s stock is currently trading at ₹237.77, with a P/E ratio of 17.52, which aligns with industry averages, indicating a balanced valuation relative to earnings.

Financial Performance (₹ in Lakhs)

- Sales:

- GSFC has demonstrated a fluctuating sales trend over the recent periods, with sales peaking at ₹11,298 Lakhs and currently standing at ₹9,045 Lakhs. The variability suggests sensitivity to market conditions and demand cycles.

- Operating Expenses:

- Operating expenses have similarly varied, with a recent figure of ₹8,583 Lakhs. The relatively high operating costs have impacted the company’s profitability in some periods.

- Operating Profit:

- Operating profit has seen significant fluctuations, from a low of ₹303 Lakhs to a high of ₹1,617 Lakhs, before dropping to ₹461 Lakhs in the latest period. The Operating Profit Margin (OPM) reflects this variability, standing at 5.10% in the most recent quarter, down from 16.59% at its peak.

- Other Income:

- Other income has been a consistent contributor to the bottom line, with a notable increase to ₹377 Lakhs in the latest period, suggesting effective management of non-operational income sources.

- Profit Before Tax (PBT):

- PBT has also shown a mixed trend, with a peak at ₹1,568 Lakhs, followed by a decrease to ₹642 Lakhs in the most recent period.

- Net Profit:

- Net profit has mirrored the PBT trend, with the latest figure at ₹511 Lakhs, down from a peak of ₹1,293 Lakhs, reflecting challenges in maintaining consistent profitability.

- Depreciation and Amortisation:

- Depreciation costs have been gradually increasing, reaching ₹185 Lakhs in the latest period, which is typical as the company continues to invest in capital assets.

- Interest Expenses:

- Interest expenses have seen a significant decline, reducing from ₹115 Lakhs to ₹11.04 Lakhs, indicating improved debt management or a reduction in borrowings.

- Dividend Payout:

- The dividend payout ratio has varied over time, with a notable reduction to 11.18% in recent periods, possibly reflecting a strategy to conserve cash for reinvestment or debt reduction.

Key Insights:

- Revenue and Profitability: GSFC’s revenue stream is strong, but the company’s profitability has been inconsistent due to fluctuating operating margins and significant variability in both operating profit and net profit.

- Cost Management: The company appears to be actively managing its interest expenses and depreciation costs, which have improved over time. However, operating expenses remain a challenge, as reflected in the volatile OPM.

- Valuation and Growth Prospects: The current P/E ratio of 17.52 suggests that GSFC is fairly valued, with room for growth if the company can stabilize its profitability. Investors should consider the company’s ability to manage costs effectively and capitalize on market opportunities.

- Dividend Policy: The company’s dividend payout has been reduced, which could be a sign of caution or a focus on reinvestment in growth opportunities. This may appeal to investors looking for long-term growth rather than immediate income.

Conclusion:

GSFC presents a case of a company with strong sales but fluctuating profitability, which may require careful consideration by potential investors. While the company has managed to improve certain aspects of its financials, such as interest expenses, the volatility in operating profit and net profit suggests that there are ongoing challenges. The stock’s fair valuation, combined with the company’s potential for growth if these issues are managed effectively, makes GSFC an interesting option for investors with a medium- to long-term outlook.

Swing Possibilities in GSFC

- Buy Range: 225 to 235

- Targets: 250/265/280/295/300/310/330/350

- Stop Loss: 210

- Holding Period: 4 to 10 weeks

Conclusion

In the current market environment, with changing dynamics and valuation concerns, it is essential for investors to be vigilant. While opportunities exist in specific stocks and sectors, the overall cautious sentiment suggests a need for careful stock selection and timely profit booking. As always, keeping an eye on technical levels and global cues will be critical in navigating the market in the coming weeks.

Disclaimer: V.L.A. Ambala emphasizes that these recommendations are based on price movement, past behavior, and technical analysis. Stay cautious and keep an eye on key levels and upcoming budget announcements to adjust your strategies accordingly.

Join SMT EQUITY Services here – https://cosmofeed.com/vig/64a2b98a2eaff10021550a62

Join SMT INDEX OPTION BUYING SERVICES here – https://cosmofeed.com/vig/6380ef829c9fa70036a1c6cd

More about the author: Vijay Laxmi, aka VLA Ambala, is a SEBI registered Research Analyst, and her research and views are published on various media platforms. Check here – https://smtstockmarkettoday.com/pr-and-media/

Follow VLA Ambala, SEBI RA, on Telegram here – https://t.me/SMTStockMarketToday

This analysis and recommendations are provided by SEBI registered research analyst VLA Ambala.

FOLLOW US ON TELEGRAM FOR MORE TRADES LINE THIS https://t.me/SMTStockMarketToday

Tags: banknifty tomorrowbansal ipoblogipo reviewlisting expacationmarket analysis for tomorrowmarket view

Tags: market analysis for tomorrow

Tags: banknifty tomorrowbansal ipoipo reviewmarket analysis for tomorrowstocks to eatch tomorrow