Market Review and Stock Analysis by SEBI Registered Research Analyst VLA Ambala

The Indian stock market has been showing significant movement, with the IndiaVIX declining by more than 6% intraday, closing above 14 on Friday’s trading session. This drop in volatility expectations has coincided with broad-based buying across sectors, notably in IT, Realty, and Auto, each of which surged by over 2% intraday. While this presents opportunities, it’s crucial to approach fresh buying with caution, particularly considering market valuations.

Nifty and Technical Indicators

The Nifty index has shown positive momentum, forming a green candlestick with a long lower shadow over the week, indicating bullish sentiment. The index traded within a 500-point range, and after eight days of consolidation, it broke out, closing above the 50-Day EMA while taking support at the 20-Day EMA.

Relative Strength Index (RSI) levels suggest that while the daily timeframe RSI is at 55, the weekly and monthly timeframes are at 69 and 77, respectively. These elevated RSI levels on the higher timeframes indicate that Nifty remains overvalued, necessitating caution in stock selection, especially for short-term trades.

Key Support and Resistance Levels

- Nifty:

- Support: 24470, 24350

- Resistance: 24630, 24745

- Bank Nifty:

- Support: 50400, 50250

- Resistance: 50850, 51150

Stock Recommendations

Given the current market conditions, it’s essential to choose stocks with careful consideration of their valuations and consolidation patterns. Below are specific stock recommendations based on recent performance and market trends.

Systematix Corporate Services

- Overview: Ideal for swing trading, though it appears overbought for mid- to long-term investment.

- Buy Range: ₹1,170 to ₹1,185.

- Target: ₹1,210 to ₹1,270.

- Holding Period: 1 to 10 days.

- Stop Loss: ₹1,120.

- Catalyst: Recent quarterly results and a dividend of ₹1 per share (Ex-Date: Sep 19, 2024).

Garment Mantra Lifestyle

- Overview: This small-cap stock is weak and not suitable for low-risk investors or traders. The stock faces low liquidity, which could be problematic, and a further price decline is likely.

- Buy Range: ₹4 to ₹4.50.

- Target: ₹6 to ₹8.

- Holding Period: 2 to 6 months.

- Stop Loss: ₹3.30.

- Catalyst: Quarterly results have influenced its current outlook.

YSL

- Overview: Trading at a 20% discount from its all-time high, but further dips are possible. It’s advised to avoid buying at overbought prices.

- RSI:

- Weekly: 66

- Monthly: 73

- Daily: 50

- Buy Range: ₹39,850 to ₹40,000.

- Target: ₹50,000 to ₹65,000.

- Stop Loss: ₹31,200.

- Holding Period: 1 to 5 months.

- Catalyst: A dividend of ₹400 per share adds to its appeal.

Pfizer

- Overview: A potential dip is expected as the stock is trading in the overbought zone, as indicated by an RSI above 71 across daily, weekly, and monthly timeframes.

- Buy Range: ₹5,000 to ₹5,130.

- Target: ₹5,670 to ₹7,000.

- Stop Loss: ₹4,700.

- Holding Period: 2 to 7 months.

Conclusion

In conclusion, while the market shows signs of bullishness, especially with sectoral gains and Nifty’s breakout, the elevated RSI levels suggest caution. Stock selection should focus on those that are consolidating and not overbought, to capitalize on potential gains while managing risks effectively. Adherence to stop-loss levels and a clear understanding of holding periods are crucial in navigating the current market landscape.

Disclaimer: V.L.A. Ambala emphasizes that these recommendations are based on price movement, past behavior, and technical analysis. Stay cautious and keep an eye on key levels and upcoming budget announcements to adjust your strategies accordingly.

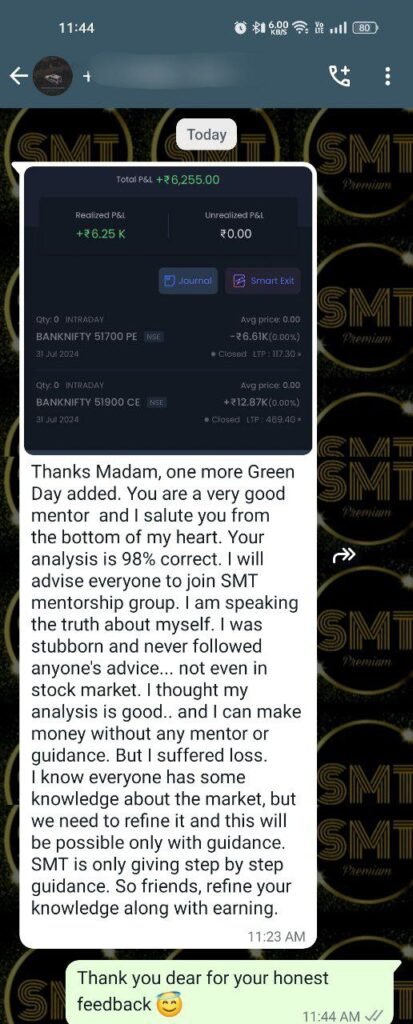

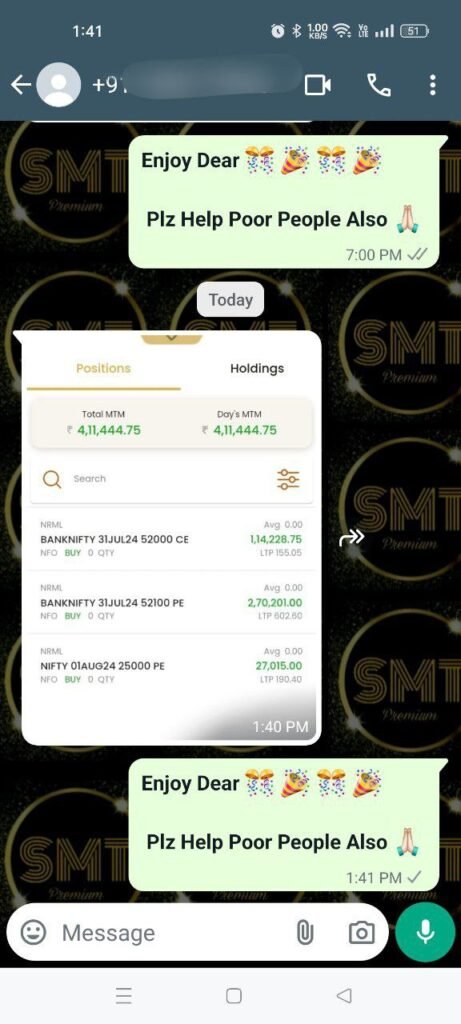

Join SMT EQUITY Services here – https://cosmofeed.com/vig/64a2b98a2eaff10021550a62

Join SMT INDEX OPTION BUYING SERVICES here – https://cosmofeed.com/vig/6380ef829c9fa70036a1c6cd

More about the author: Vijay Laxmi, aka VLA Ambala, is a SEBI registered Research Analyst, and her research and views are published on various media platforms. Check here – https://smtstockmarkettoday.com/pr-and-media/

Follow VLA Ambala, SEBI RA, on Telegram here – https://t.me/SMTStockMarketToday

This analysis and recommendations are provided by SEBI registered research analyst VLA Ambala.

FOLLOW US ON TELEGRAM FOR MORE TRADES LINE THIS https://t.me/SMTStockMarketToday

Tags: banknifty tomorrowbansal ipoblogipo reviewlisting expacationmarket analysis for tomorrowmarket view