Waaree Energies, a prominent player in India’s solar photovoltaic (PV) module manufacturing sector, is set to launch its Initial Public Offering (IPO). With the global shift towards renewable energy and India’s ambitious solar targets, this IPO has garnered significant attention from investors eager to engage in clean energy initiatives. This article presents an in-depth analysis of Waaree’s IPO prospects, evaluating its financial health, industry positioning, and the macroeconomic factors influencing the solar market.

Industry and Market Outlook

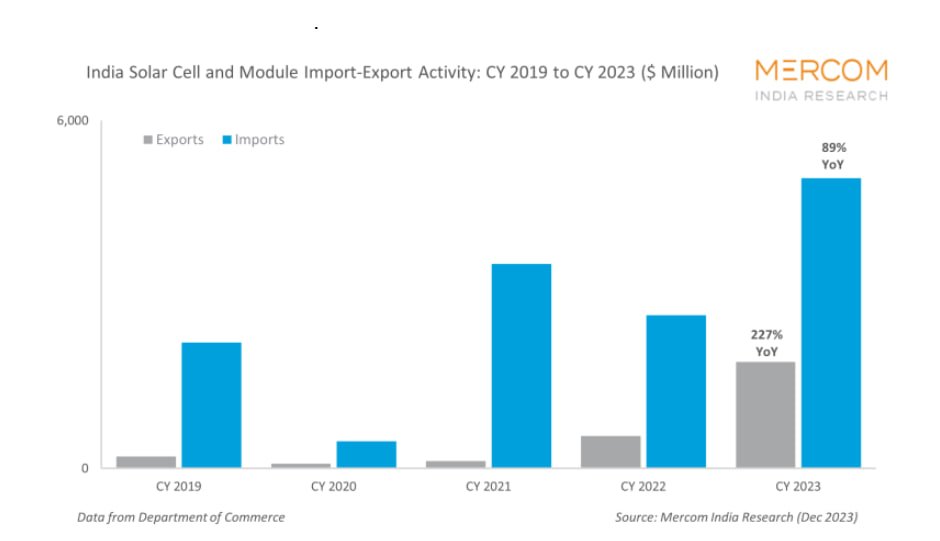

Performance of the Indian Solar Market-The Indian solar market has witnessed remarkable growth, significantly bolstered by a Mercom India report highlighting a 227%increase in solar exports year-over-year in 2023. This surge can be attributed to the rising demand from the United States, which accounted for 97% of India’ssolar exports, following the imposition of tariffs on Chinese solar products.Additionally, domestic demand for photovoltaic components has led to an 89%increase in solar imports as India accelerates its solar capacity installations.

This scenario positions, Waaree Energies favorably to capitalize on growing export opportunities amid geopolitical shifts favoring Indian manufacturers. The increased focus on domestic production aligns with the Indian government’s strategy to enhance self-sufficiency in solar energy, making Waaree’s offerings even more relevant.

Q2 2024 Total Installed Capacity in India-

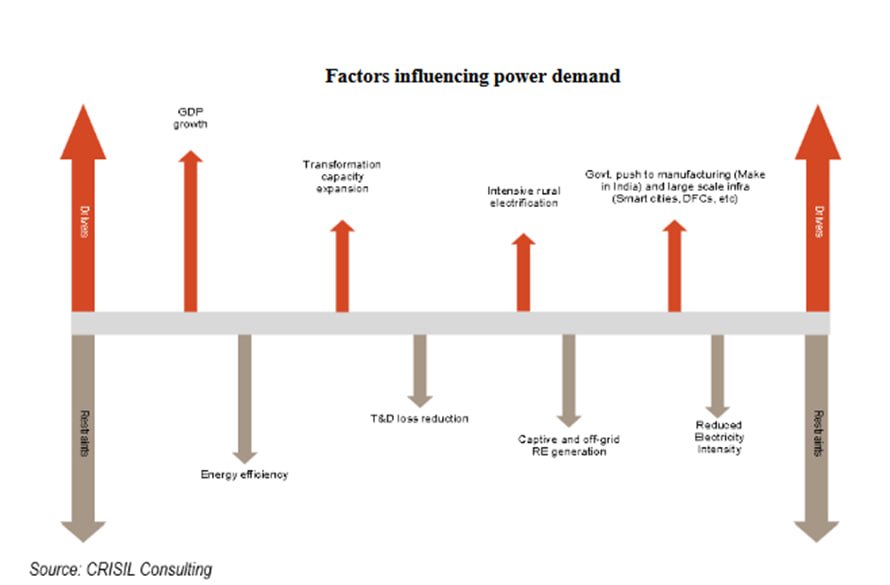

WHY SOLAR INDUSTRY IS GROWING SO FAST–

Module Reliability and Manufacturing Capabilities

According to the Ministry of New and Renewable Energy (MNRE), Waaree Energies is included in

the Approved List of Models and Manufacturers (ALMM) under the government’s order for solar PV modules. This listing signifies compliance with quality standards, which is crucial for maintaining market trust.

India’s solar manufacturing industry is on an upward trajectory, with cumulative solar

module manufacturing capacity reaching 77.2 GW and solar cell capacity at 7.6 GW as of June 2024. The top ten manufacturers hold approximately 58% of the market share, emphasizing the need for companies like Waaree to innovate continually. Looking ahead, India’s solar module capacity is projected to reach an impressive 172 GW by 2026, driven by advancements in technologies like Mono PERC (Monocrystalline Passivated Emitter and Rear Cell) and the introduction of newer technologies like Tunnel Oxide Passivated Contact (TOPCon). The expected dominance of Mono PERC technology (57.2% in module production) indicates a stable market for Waaree, which focuses on high-performance products.

Competitive Landscape – Waaree Energies operates in a highly competitive environment, facing rivals such as Tata Power Solar, Vikram Solar, and international giants like Trina Solar and JinkoSolar. Maintaining technological advancements and competitive pricing will be crucial for Waaree to preserve its market share. The company’s diversification into solar cell manufacturing and extensive Engineering, Procurement, and Construction (EPC) services provide a competitive edge in cost control, allowing it to mitigate risks from supply chain disruptions. –

Waaree’s Financial Overview (as of June 30, 2024)

– Revenue: ₹3,496.41 crores

– Profit After Tax (PAT): ₹401.13 crores

– Net Worth: ₹4,471.71 crores

-Debt/Equity Ratio: 0.06

– Market Capitalization: ₹42,939.36 crores

Key Performance Indicators (KPI)

– Pre-IPO- EPS: ₹48.69

– Post-IPO – EPS: ₹56.16

– P/E Ratio- (Pre-IPO): 30.87

– P/E Ratio – (Post-IPO): 26.76

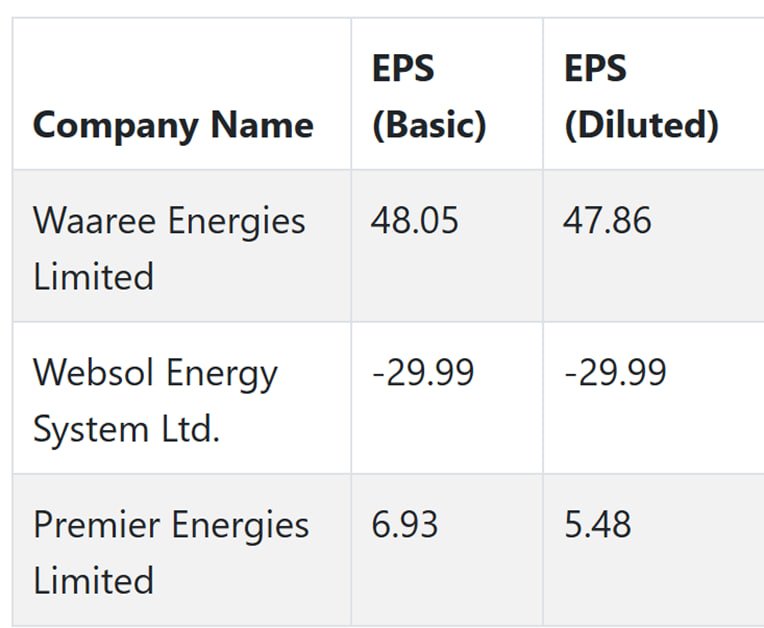

PEER COMPARISON –

Competitive Advantage-

Waaree Energies has maintained its market leadership through a combination of strong manufacturing capacity, technological innovation, and a diversified product portfolio. With a 12 GW manufacturing apacity, the company is one of India’s largest solar module producers, supplying high-quality modules for large utility-scale projects, rooftop installations, and residential solar systems.

Backward Integration: The company’s backward integration into solar cell manufacturing and its extensive EPC services give it an edge in cost control, allowing Waaree to reduce its reliance on external suppliers and protect its margins against supply chain disruptions.

Global Export Potential:

Waaree’s ability to export its products to over 20 countries, especially with growing demand from markets like the U.S., Europe, and the Middle East, further strengthens its global footprint. The recent growth in solar exports, as highlighted by Mercom India, positions Waaree favorably in an expanding

international market.

IPO Overview for Waaree Energies –

– Issue Size: ₹4,321.44 crores

– Fresh Issue: 2.4 crore shares (₹3,600 crores)

– Offer for Sale: 0.48 crore shares (₹721.44 crores)

IPO Dates Key dates-

– Open for Subscription: October 21, 2024

– Close for Subscription: October 23, 2024

– Allotment Date: October 24, 2024

– Listing Date: October 28, 2024

Price Band ₹1,427 to ₹1,503 per share

Minimum Lot Size- 9 shares

Minimum Investment-

– Retail Investors: ₹13,527

– sNII (small HNI): ₹202,905 (15 lots, 135 shares)

– bNII (big HNI): ₹1,000,998 (74 lots, 666 shares)

Reservation Details

– Total Shares Offered: 28,752,094 shares

– QIB: 5,538,663 shares (19.26%)

– NII: 4,373,206 shares (15.21%)

– Retail Individual Investors (RII): 9,911,869 shares (34.47%)

– Employees: 432,468 shares (1.5%)

– Anchor Investors: 8,495,887 shares (29.55%)

Use of IPO Proceeds-: Waaree intends to use the IPO proceeds for expanding its solar module manufacturing capacity, increase working capital, and funding general corporate expenses. This expansion is timely, considering the rising domestic demand and export potential driven by favorable international trade conditions.

Financial Performance and IPO Objectives-

Waaree plans to utilize the IPO proceeds primarily to expand its solar module manufacturing capacity and increase working capital. This expansion is timely, given the rising domestic demand and export potential driven by favorable international trade conditions.

Favorable Government Policies- The Indian government has been proactive in promoting renewable energy through various initiatives, such as the National Solar Mission, which aims to achieve significant solar capacity installation by 2022. Supportive policies, coupled with international trade dynamics favoring Indian manufacturers, create a

conducive environment for Waaree’s growth.

Waaree Energies has built a reputation for strong governance and management practices.

The company’s leadership has articulated a clear vision for expansion,

emphasizing sustainable growth, technological innovation, and global

competitiveness. This strategic focus positions Waaree as a company capable of

navigating the challenges of the evolving solar market.

Conclusion: A Must-Subscribe IPO by VLA Ambala SEBI Registered Research Analyst- The Waaree

Energies IPO represents a compelling opportunity for investors seeking exposure to the burgeoning renewable energy sector. Key factors supporting this investment include:

Valuation in Business Category: Waaree’s strong market positioning, coupled with favorable

pricing in the IPO, makes it an attractive investment.

– Peer Comparison: Waaree’s – competitive advantage over peers in terms of manufacturing capabilities and product quality enhances its attractiveness.

– Scope for Business Expansion: The projected growth in solar capacity in India provides substantial

room for Waaree to expand its operations.

– Global and Domestic Demand:

The rising global demand for solar products positions Waaree favorably for

increased exports.

– Favorable Government Policies: Continued support for renewable energy initiatives

bodes well for Waaree’s long-term prospects.

–Impressive Financials: Strong revenue and profit growth, alongside minimal debt, strengthen the

investment case.

– Good Governance by Management: A clear vision and robust governance practices instill confidence in

the company’s ability to execute its growth strategy.

IPO Overview- HOLD OR BOOK PROFIT POST LISTING STRATEGY in WAAREE IPO

As a SEBI-registered research analyst, I recommend that investors consider must subscribing category the Waaree Energies IPO. Given the company’s established market presence and the potential for long-term growth in the renewable energy sector, it stands as a promising investment opportunity. Stay invested with premium for more multifold gains in this industry leading stock, Waaree Energies.

So, I hope this detailed analysis can serve as a comprehensive guide for you, helping you to make informed decisions about the Hyundai IPO. Would you like to get any IPO or stock review by us? Yes- Drop a comment Ill try to review it for you.

Thanks VLA Ambala – SBEI RA

Post listing updates will be given in our Telegram Community, please follow here https://t.me/SMTStockMarketToday

. 💥BUY 1 GET 3 OFFER💥 Valid for Now

💥BUY 1 GET 3 OFFER💥 Valid for Now

FUTURES CHANNEL

https://cosmofeed.com/vig/630e26ddd60d9956653c8e86

INDEX OPTION CHANNEL

https://cosmofeed.com/vig/6380ef829c9fa70036a1c6cd

EQUITY CHANNEL [INTRADAY & SWING]

https://cosmofeed.com/vig/64a2b98a2eaff10021550a62

BTST CHANNEL

https://rpy.club/g/ppTw6ZA715

STOCK OPTIONS CHANNEL

https://cosmofeed.com/vig/63078ab976384f54d010b76f

ANY QUERIES 👇🏻

https://wa.me/+918459443615

Read investor charter in the pinned message Pay attention – “ Investment in securities market are subject to market risks. Read all the related documents carefully before investing.